It’s no secret that the construction industry is one of the toughest when it comes to managing cash flow. From large upfront job costs to unexpected change orders, it’s not uncommon for contractors to experience pretty significant delays in payment. As if that weren’t challenging enough, contractors also have to think about retainage, or the money withheld until a project owner is satisfied with a job’s completion. When not reimbursed quickly, these withheld funds can create cash flow problems and affect a construction company’s profitability.

Still, while retainage might be a given in most jobs, that doesn’t mean it has to hurt you. In this guide, we’ll explain the basic rules of retainage and how to ensure you bring home 100% of what you’re owed.

Key Takeaways

- Retainage is the practice of holding back a portion of progress payments on a job to ensure the successful completion of each milestone.

- Retainage rates can be either fixed or variable and typically represent around 5-10% of a job’s total payment.

- Consistent recording, tracking, and communicating with project owners can ensure you’re reimbursed on time for any retainage held back.

What is Retainage?

In construction, retainage is the practice of holding back a portion of payments on a job as a kind of financial incentive that ensures each milestone is successfully completed. Often, this happens between a project owner and the general contractor but can also be used between general contractors and their vendors/subcontractors.

Retainage is considered a standard practice in construction accounting and is designed to not only protect project owners but to encourage contractors to complete a job as agreed upon. If, for some reason, a job falls short in its progress or materials, this held-back amount should be able to cover the cost of replacement labor or supplies.

Although retainage rates can vary, you’ll typically encounter a range from five to ten percent. Even at the lower end, this can be a sizable chunk of money, especially for new businesses and smaller contractors who might not have the resources and cash reserves to easily overcome this impact to their cash flow. What’s more, contractor profit margins and retainage amounts usually fall within a similar range, which means fulfilling your contractual obligations on every project is essential to fully recovering your profit on each job.

How to Calculate Retainage

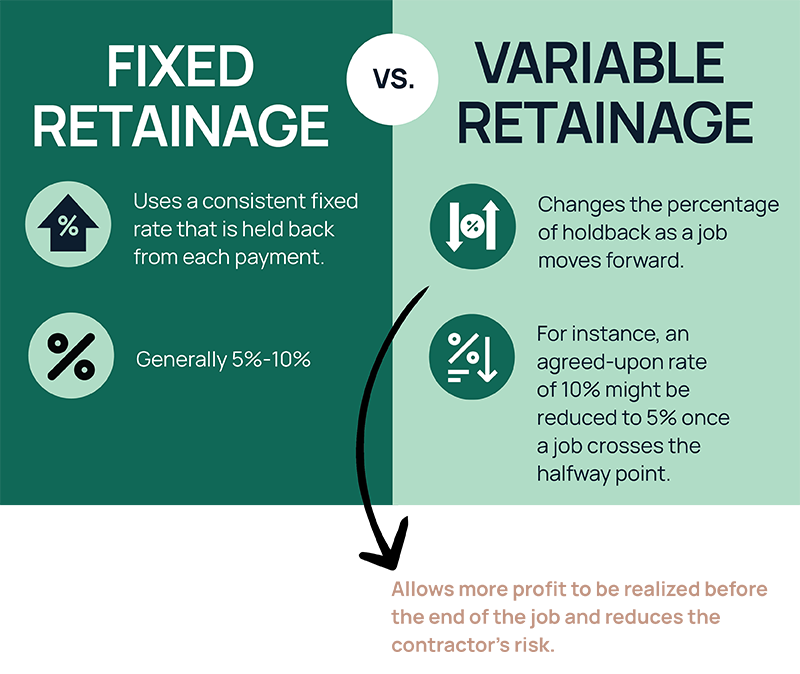

Retainage in a construction project can be either fixed or variable.

Fixed retainage uses a consistent fixed rate – generally between five and ten percent – that is held back from each payment.

Variable retainage changes the percentage of retained funds as a job moves forward. For instance, an agreed-upon rate of 10% might be reduced to 5% once a job crosses the halfway point.

The specifics of each job’s retainage, including the rate of holdback and payment schedules, should be clearly detailed in the contract agreement.

A Simple Example of Fixed-rate Retainage

Let’s say you’re about to sign a contract for a job scheduled for a total of ten payments of $30,000 each, with an agreed retainage percentage of 10%.

To calculate your expected holdback, simply multiply the scheduled payment amount by the retainage rate. In this case, a $30,000 payment x 10% retainage would equal $3,000 in holdback for each payment.

So, each of your ten scheduled payments will be reduced by $3,000 for a combined retainage of $30,000 and a total of $270,000 paid over the course of the job. At the end of the project, you should receive full payment of that $30,000 in holdback (likely a large portion of your profit for the job).

Recording and Tracking Retainage Receivables

Recording and tracking retainage can seem confusing at first, but here’s a quick breakdown of what you need to know.

Proper recording and tracking starts with adding the right fields to your Chart of Accounts. Given how important your CoA is in ensuring accurate accounting, including an account for retainage receivables is essential.

Next, make sure that retainage is correctly recorded on your company’s balance sheet. If you’re owed retainage, the held-back amounts should be recorded as an asset, while whoever owes retainage should enter the amount as a liability. Retainage receivables will show as a debit balance, while retainage payables are considered a credit.

Accounting for retainage payables generally means tracking holdback from contractors, subcontractors, and vendors throughout the entire project. Just like with retainage receivables, retainage payables will also need to be included on your Chart of Accounts to accurately track related transactions and balances.

If we follow generally accepted accounting principles (GAAP), once your retainage payables are invoiced, they’ll move to accounts or subcontract payables. Likewise, retainage receivables move to accounts receivable when billed. Under GAAP, your accounts receivable are debited for retainage, while accounts payable are credited an identical figure. This is an important distinction to remember, because retainage balances don’t have due and payable dates. Only when retainage has been moved to AR or AP can due dates be applied.

Collecting Retainage

Remember how we said that the amount of retainage is often also the same amount of profit you’ll make on a job? Given that your profit margin can be tied up in the retained funds, your ability to collect it at appropriate times is critical to maintaining a healthy cash flow.

Substantial Completion

Substantial completion is when a job has been sufficiently completed to the owner and/or contract specification and the owner can use it for their intended purpose. Substantial completion could have specific items which might need to be met to happen like a permanent certificate of occupancy. Many projects will have a contractor bill retainage upon project completion or “substantial completion”. This type of flow does not work well for many contractors because you are waiting for substantial completion on a job and different trades finish at different times on the same project.

Once substantial completion is achieved all the contractors on a job will normally put in retainage billings. On large projects, if you were one of the first contractors working on the project, you could end up waiting years for your retainage billing. This makes managing cash flow very difficult. In situations like these, we would suggest you attempt to get a retainage reduction rider included in the project with the owner. A retainage reduction rider reduces the amount of retainage withheld on the project as completion milestones are hit based on the amount of work completed.

Protecting Your Retainage

Make sure to protect your retainage and other progress billings by filing the proper mechanic’s lien on the public project you are working on. A mechanic’s lien is the legal right to be paid for the services rendered to physically modify a property. There are different state laws concerning how to file a mechanic’s lien for retainage so check with your state to make sure you are filing correctly. You don’t want to get to the end of a project that has funding issues and learn you are not able to have a mechanic’s lien on your retainage.

It’s important to note that mechanic’s liens are often handled differently in public projects vs. private projects. Public projects are funded through taxpayer dollars and many times they do not allow for liens to secure your retainage and other billings. However, these projects will normally have a bond on them to ensure all payments are made. To ensure you can collect your retainage on a public project you need to get a copy of the bond for your record in case you need to collect off of the bond.

Legal Considerations to Keep in Mind

Legal requirements and regulations for retainage vary by state. Some jurisdictions might require the release of retainage fees within a defined period of time after a project is finished. Others might require reimbursement to be made in a set number of days after final approval. Some states even limit the amount of money that can be retained, and some might require it to be held in escrow.

Either way, we recommend looking into your state’s specific rules and requirements – including how your state defines completion of a project versus final approval of the job – to avoid any confusion.

If you have any questions or concerns, it’s critical to address them before signing a new contract. Don’t hesitate to clarify things with your legal department or a qualified construction law attorney – you’ll thank yourself later.

Making Retainage Work for You

Given that retainage can frequently parallel your expected profit margins on a particular job, it’s important to set yourself up for success from the get-go. There are a few best practices we recommend here, including:

- Negotiating favorable terms and percentages. For example, requesting variable rates that decrease as a job successfully progresses.

- Ensuring the terms of the contract you sign specifically spells out all the terms and conditions related to the release of retainage.

- Addressing any concerns before starting on a job

Of course, communication plays a huge role in this. Before the construction contract is finalized and a job begins, every party should be clear on the details and expectations related to retainage. Throughout the job, you’ll want to stay in communication with owners, subcontractors, and vendors to make sure everyone is on the same page in terms of progress, payment status, and any changes in job scope. Things can easily be forgotten, misremembered, or misunderstood, so keeping written documentation of communications, invoices, and receipts is a must.

Lastly, you’ll want to double-check you’re accurately accounting for retainage in your billing and invoice process. When done right, any unreleased retainage should reflect as revenue on your profit and loss statement, and as uncollected funds on your balance sheet.

Streamlining Retainage with Construction Accounting Software

Retainage might be an unavoidable aspect of the industry, but with enough preparation, it’s possible to manage its risks and streamline the process. Instead of relying on outdated tools and methods to account for holdback, construction-specific account software like CrewCost makes the process simple.

Purpose-built by contractors for contractors, CrewCost’s construction accounting software is made to automate billing, invoicing, payment tracking and more – including managing retainage receivables and payables. 100% cloud-based, CrewCost’s job dashboards enable real-time reporting and actionable data, anywhere, any time, so you can make better decisions, improve your cash flow, and grow your business.

Sign up for free and see how easy it is to use CrewCost.