We get it - you didn’t get into construction to stare at spreadsheets every day. But while you might be more comfortable with tools than a Google Sheet, every contractor needs to know their way around the basics of accounting, especially job costing. Thankfully, construction accounting is kind of our thing, so we’ve built a tool to get you started.

Whether you’re new to construction job costing or you’re looking for a better process, you can use our free template to manage project budgets and make sure your business is making a profit.

💥 Download the Job Costing Google Sheets Template

💥 Download the Job Costing Excel Template

Before we move on to how to use this template, did you know that you can automate much of the manual work of job costing if you have purpose-built construction accounting software? Schedule some time to talk with us and we'll show you how.

Why Every Contractor Should Make Time for Job Costing

Job costing is one of those things you don’t realize you need until you start seeing the results. Instead of flying blind on project after project, job costing allows you to set a job’s budget, track project expenses against that budget, and use that information to bid better in the future. Instead of trying to track everything through one income statement, job costing gives you the bird’s eye view you need to actually grow your business sustainably.

Of course, job costing takes time and effort that could be spent on the jobsite, which is why a lot of newer contractors have trouble making it a habit. And although we can’t do job costing for you, we can give you a head start. With our free job costing template, you can plug in your project’s numbers and start tracking profitability immediately.

Keep reading for a step-by-step tutorial on how to use our job costing spreadsheet template.

How to Use Our Free Job Costing Template

Our job costing template is designed to work for most small-to-midsize contractors. Depending on your business’s unique situation, you may need something more robust, but this simple template will be enough if you’re just starting out.

A quick callout before we get started: To get the most out of this job costing template, you’ll need to know your profit amount/markup. This way, you can track your revenue and current profitability on every job.

A Step-by-Step Guide to Job Costing With Our Template

If you’re not organized, you’re not going to be able to job cost properly. When you open up the template, you’ll notice a place to record the date, job name, and job number. Don’t forget to change the information here for every new job. You can also rename each individual spreadsheet at the bottom of your screen (we recommend using the job number here to keep things simple).

Once you’re set up with your specific project info, we can get started with job costing.

1. Create a budget or estimate for the job

The first step of job costing is creating a budget or estimate for the construction project. Decide if you want to either break the job out into specific “products” or by line items for your schedule of values. If it’s a simpler job, you can also keep track of the budget without breaking it out.

2. Define your cost codes

Cost codes are unique numerical identifiers that help you keep track of specific costs within specific categories. This way, you can consistently allocate expenses across multiple jobs.

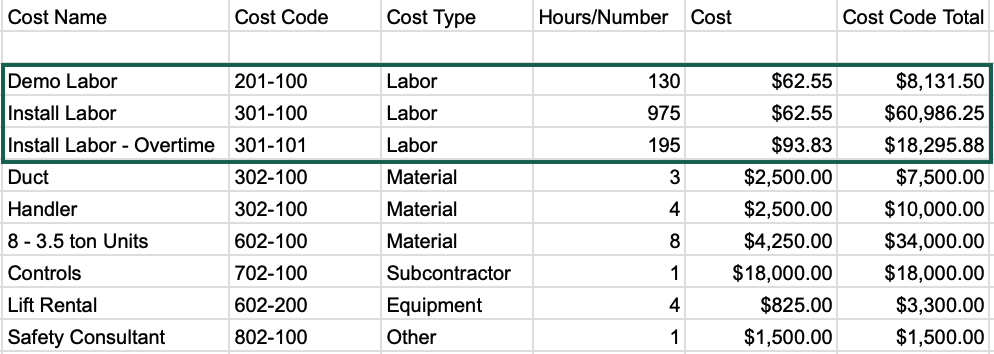

Take a look at the sheet, “Job 10001” for a simple example of cost codes in action. Under the bigger category of Labor, you can see three cost codes that break out this category: Demo Labor, Install Labor, and Install Labor Overtime.

Each one of these has a specific cost code associated with it. These cost codes make it easier to measure estimated vs. actual costs (something you’ll need to track overtime if you want to make more accurate estimates in future jobs).

3. Create a total for all the costs by type from your project budget

Once you have your total project budget, you’re going to break that down into the categories of Labor, Materials, Subcontract, Equipment, and Other.

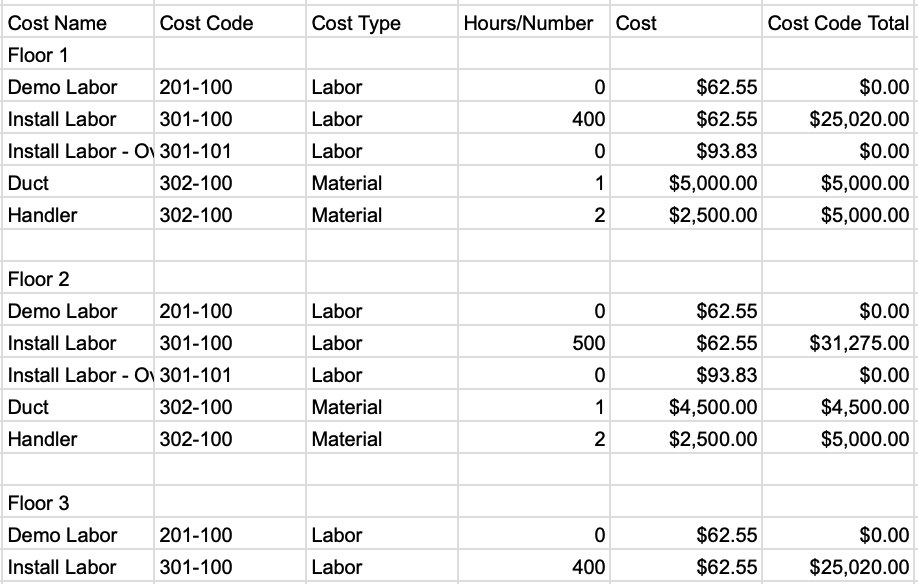

Take a look at the third template sheet “Job 10002” for a simple example. Here, the total project budget is broken down by floor, which is broken down further by labor, materials, subcontractors, and equipment.

4. Enter the entire budget amount for each cost type under the “Budget Amount” column

Now let’s start plugging in the numbers. Continuing with the previous example on the “Job 10002” sheet, let’s say you’ve allocated $25,020 for labor and $10,000 for materials for Floor One. You’ll add these amounts under the “Budget Amount” column.

Once you’ve added all of the amounts for each floor, you should see your original budget for that specific job under the “TOTALS” line.

5. Record costs as they’re spent throughout the job

As you start to incur costs on the job, you’ll keep track of them in the “Cost to Date” cells. You’ll want to do this before you have your job cost meetings. Try to make this a monthly habit.

When costs go up, you’ll see the “Forecast to Complete” number and “% Complete” numbers change. These columns are particularly important to keep an eye on. For instance, if your % Complete column shows 75% of your labor costs for Floor One have been spent, but only 50% of the work on the jobsite has been done, you know you’re potentially in for a budget overrun if you’re not careful.

6. Track change orders as needed

Need to put a change order in? Record it in the “Change Order” cell and add more change order cells as needed. This will create a “Revised Budget” for the line items affected. This revised budget will be the new number you’re using to complete the job.

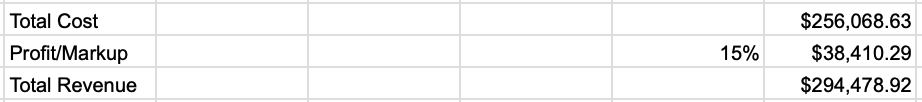

7. Figure out your total revenue and profit

Once the job is done, you’ll record the total cost, along with your profit/markup to arrive at your total revenue. Check out our example on the first sheet, “Job 10000”.

Job Costing Best Practices

It’s impossible to include everything you need in one template, so here are just a few more best practices to keep in mind as you’re job costing projects.

Record Costs in Real-Time

Instead of reporting costs after a job is finished, you should be entering costs incurred (as well as anticipated costs) in real-time, or at least monthly. By recording them earlier in the process, you can proactively manage and control them, reducing the possibility of overruns.

🔎 Dive Deeper: Cost Control in Construction: Strategies for Maximizing Efficiency

Link Job Costing With Your General Ledger

By integrating your job costing system into your company’s general ledger, you can make sure your revenue and costs match up with your income statement. If they don’t, you’ll need to sniff out the issue before it causes bigger problems.

Use What You Learn

At its core, job costing is all about continuous learning and improvement. You’re not simply collecting data to collect data. The goal here is to use the data you’ve gathered to learn from any mistakes and create more competitive, profitable project estimates in the future.

🔎 Want to go even more in-depth into job costing? Check out our comprehensive guide here.

👉 You can do a lot with a good ‘ole Microsoft excel spreadsheet or Google Sheet, but no matter how fancy you get with it, it still requires hours of manual work to keep up with all the data you need to make informed decisions. If you’re ready to cut out the manual work and see your project budgets in real time, check out CrewCost's accounting and job costing software. It’s specifically built for a construction company’s workflows and brings accounting, job costing and time tracking all into one platform. With easy to read dashboards and reports you’ll have no trouble tracking your metrics in real time. Schedule a demo and see it for yourself!