How Progress Payments in Construction Work

Cash is king in the construction industry. And for many contractors, the biggest worry on a job isn’t shortages or delays, but maintaining a healthy cash flow. Keeping enough cash on hand is hard enough as is, but when you’re only getting a lump-sum payment at the end, it becomes that much more difficult.

On longer projects, you need a regular inflow of cash to recoup upfront costs. Progress payments allow you to bill on a consistent schedule as the project progresses, so you can keep that inflow coming. Here we’ll look at how progress payments in construction work, and how things like retainage factor in.

Key Takeaways

- Instead of a lump-sum at the end, or half upfront/half later, progress payments in construction are made in regular installments as work progresses on a job. These payments are tied to payment applications, and are usually billed on a monthly basis.

- Progress billings are the most commonly used billing method with lump-sum, GMP, and cost-plus contracts.

- If the contract terms include a retainage percentage, this amount will be held back with every progress payment. This retention will typically be paid back at project completion, (unless you negotiate otherwise).

What are Progress Payments?

Whether you’re a general contractor or subcontractor, you probably spend a significant amount of money to get a construction project off the ground. If you can’t bill for your work until the end, you’re going to be pretty deep in the red until you can recoup all those costs. Progress payments make this tough cash situation a little easier by allowing you to bill for partial payments based on the amount of completed work. At the beginning of the contract, you and the project owner or general contractor, will agree upon specific milestones and payment schedules.

Progress payments in construction are tied to your payment applications. Put simply, how much work you’ve put in place on a job determines what you can bill based on the contract price. On longer jobs, payment applications usually happen on a monthly basis, although on smaller jobs, it could be weekly. Each payment application should mirror your progress toward project milestones in your schedule of values.

Different Types of Billing Structures

The most common billing methods in construction are lump-sum, guaranteed maximum price (GMP), cost-plus, time and materials (T&M), and unit pricing. We go over all of these billing structures in more detail this article on construction billings, but here’s a quick overview of how they work, and which of them use progress payments:

- Lump-Sum - These contracts are often the default in construction. Under this contract type, the contractor and owner agree to a fixed contract price upfront before work starts. Progress payments are common in lump-sum work, and are usually payable either on a monthly basis, or by project milestone.

- Guaranteed Maximum Price (GMP) - GMP jobs are similar to lump-sum. The big difference is that the owner benefits from cost savings instead of the contractor if the final cost is under budget. These jobs can also use progress billings, which are usually done on a monthly cadence. If there is a shared savings clause though, you’ll have more requirements around billings.

- Cost-Plus - These contracts cover the project’s total cost plus a set profit markup, and are usually used when the scope of work is uncertain. Progress payment applications are typically on a monthly basis too.

- Time and Materials (T&M) - Common on smaller projects, T&M lets contractors invoice for labor hours, the cost of materials, their profit margin, and sometimes overhead. Unlike the other billing structures we’ve mentioned, T&M billings can be sent bimonthly, monthly, weekly, or even daily.

💥 Want to better forecast your cashflow and profitability? Check out the Ultimate Guide to Construction Accounting for Emerging Contractors.

How to Bill Progress Payments in Construction

The payment process for progress payments is fairly straightforward. When you’re ready to bill, you’ll request a progress payment through a payment application. The contract should include information on these payment applications. Depending on the job, you might be required to submit a billing form provided by the owner/entity you’re contracted with, your own billing forms, AIA billings, or use a type of billing software assigned by the person above you. Once your payment application and backup documentation is sent, then you wait to get paid, then rinse and repeat. This could include doing a detailed schedule of values where you show what progress you’ve made within each portion for the billing period.

One of the nice things about getting paid as you go is that it’s easier to notice cash flow and payment problems quickly. For example, if the first few progress payments on a job were made in a timely manner, but now they’re coming late (or not at all), you may be able to stop work until you’re paid. If you had waited to receive a lump-sum at the end, you might have been in for a rude surprise if the owner couldn’t pay up. In that scenario, your only option for dispute resolution may be a lawsuit.

How Retainage Works With Progress Payments

If you’ve worked a job with retainage, you know it can be a pain to deal with. Essentially, retainage is when a percentage of the total project cost (normally 5-10%) is withheld from contractors until the work is finished. In practice, this looks like a percentage held back from each payment application you send. Note that retainage billings are separate from progress billings, which are billed on their own.

Here’s an example:

Let’s say your construction business does its first progress billing on a job with 10% retainage. You bill $1000 for your gross progress billing. 10% retainage = $100, which means you get a $900 net progress billing. Later, you’ll bill the remaining retainage balance.

If you can, you want to establish terms in your contract that let you bill retainage as you move along through the job. This way, you don’t have to wait to bill the total amount at the end.

When it’s Best to Use Progress Billings

Progress payments are pretty standard on longer projects. If a project is over three months for example, you’ll almost always use them. If the construction contract is shorter though, you’ll usually see a large down payment, then a final payment when the job is done. Progress payments don’t make as much sense on these jobs because this small window doesn’t affect cash flow as much as bigger projects.

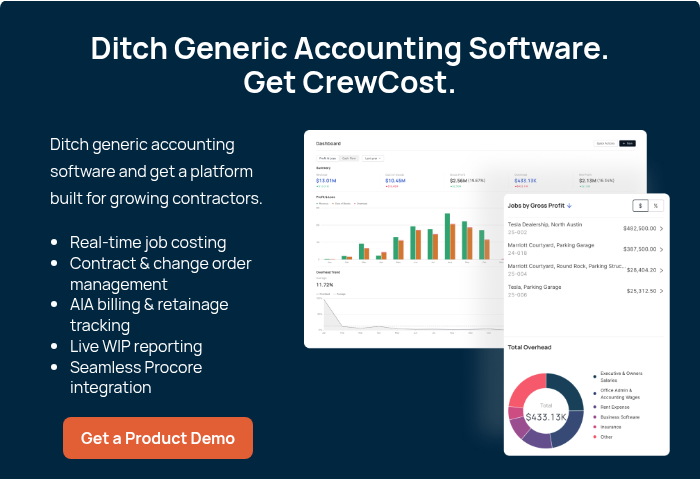

Ready to see how purpose-built construction accounting software can help you build a more profitable business? Schedule a demo of CrewCost today!