The Purpose of Construction Cost Types

In any construction project, categorizing costs into separate types serves multiple strategic purposes:

First, it enables contractors to get a highly detailed analysis of where their financial resources are being allocated on jobs, which aids in effective budget management and financial forecasting. By breaking down costs into categories like labor, materials, equipment, subcontractors, and ‘other’ indirect expenses, GCs gain a greater understanding of the actual costs associated with their projects. This approach enables them to make more informed decisions, optimize resource allocation, and enhance their negotiating power with suppliers and subcontractors.

Categorizing construction costs by type also helps facilitate transparency with all project stakeholders throughout the project lifecycle. It does this by simplifying complex financial data, and making it accessible and understandable, which is crucial for reporting and for maintaining trust. Additionally, it provides a structured framework for financial accountability and compliance, ensuring all project expenditures are tracked and audited according to established financial standards as the construction process progresses.

Finally, breaking down construction operations by cost types allows GCs to glean detailed cost data, which makes estimating future work much easier.

For example, let’s say you track the placement of a 1000 sq ft. concrete slab on grade on one project and determine the detailed labor, material, and equipment costs it takes to complete the work. Then, when you go to estimate the next slab placement, (even if it’s a different size), you’ll have an understanding of the component costs that go into that specific task and will be able to create an accurate cost estimate for constructing the next slab.

Taking this example one step further, what if you’re estimating a similar concrete slab placement in a new market where the labor prices are different? You can isolate that cost and manipulate your construction cost estimate to reflect the fluctuations in that specific cost while holding all of the other cost type components constant. Now you can pinpoint specific areas of cost and control them, leading to tighter, more competitive pricing and, ideally, more work.

Cost Types vs. Cost Codes

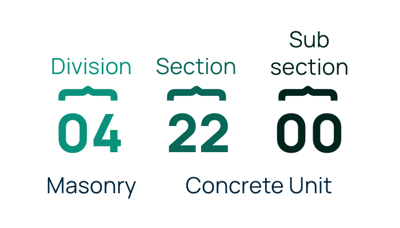

Construction cost types and cost codes work together to organize project financials and align reporting from job to job. These codes are a set of standardized categories (generally numeric values with a specific number of digits) that allow contractors to categorize project costs with even more detail. For example: 04 22 00 - Concrete Unit Masonry

While the specific costs they represent can get pretty granular, every cost code is tied back to one of the five cost types (Labor, Materials, Equipment, Subcontractors, and ‘Other’).

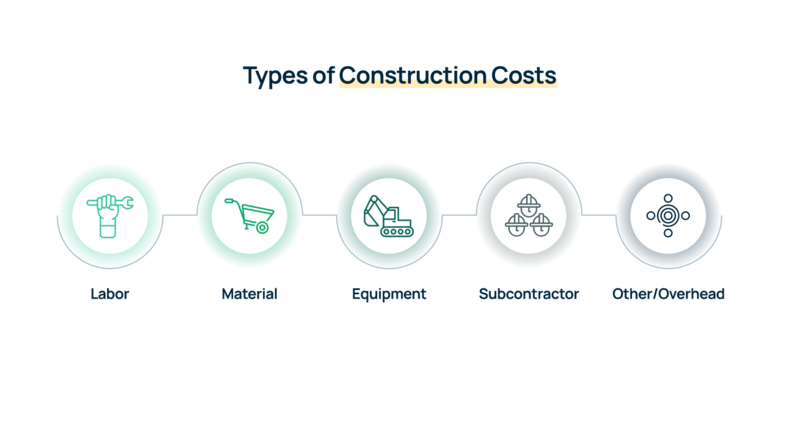

Now, let’s take a look at these five cost types in more detail.

The 5 Types of Construction Cost Types

While every construction project is different, they’ll all typically incur these five types of costs.

Labor Costs

Labor costs represent one of the most significant expenses in construction projects. They include wages, overtime, benefits, and other compensations paid to workers and management staff involved in the project. Effective management of labor costs requires understanding the labor market, implementing efficient workforce scheduling, and investing in training and safety programs to enhance productivity and reduce costly accidents or rework.

To better manage labor costs, start with understanding the production rate of the construction activity and identifying any bottlenecks or obstacles that are reducing production efficiency. Once these issues are identified, you can take steps to reduce their impact.

Material Costs

Materials are the building blocks of any construction project, and their costs can fluctuate significantly based on market trends, supply chain constraints, availability, and quality. Strategic procurement, like bulk buying and early contracting with suppliers, can lead to substantial cost savings.

GCs need to develop a keen eye for quality assessment and a good understanding of the supply chain to manage material costs effectively, ensuring purchases are aligned with project timelines and budgets. And to accurately estimate future work, you’ll want to keep track of historical material costs associated with an activity. For instance, the price of copper can dramatically fluctuate. Knowing what costs you’ve typically incurred for a similar activity in the past, cross-referenced with current material prices, can help you build competitive bids (while protecting yourself from a bust).

Equipment Costs

Equipment costs encompass the purchase, rental, maintenance, and operation of construction machinery and tools. Whether you decide to buy or rent equipment can significantly affect a project's capital outlay and operational expenses. Effective management involves evaluating the cost-benefit of leasing versus buying, considering the project duration, and the potential for future use of the equipment in other projects.

Regardless of whether the equipment is rented or purchased, tracking the direct costs associated with its use in specific construction activities is crucial. Heavy equipment is always going to be costly, and knowing what you’ve paid in the past will help ensure you’re able to keep future costs in check.

Subcontractor Costs

Subcontractors are often essential for specialized tasks that require specific, specialized skills. Costs associated with hiring subcontractors include their wages, materials, fee, and other expenses they incur. Managing these costs involves carefully selecting subcontractors based on both price and quality, negotiating terms that align with the project’s budget, and closely monitoring their progress and efficiency.

Understanding historical subcontractor costs for a specific work activity will provide a great deal of insight into future bids submitted by subs. Knowing the ballpark costs by square footage, volume, etc. that subs have charged in the past is knowledge you can use to make sure you’re getting the best number when negotiating with future subcontractors.

Other Costs

Although they’re not directly tied to physical construction activities, indirect costs like permits, insurance, temporary facilities, temporary materials, disposal fees, utilities, and legal fees, make the operation of a construction project possible. And while these additional costs are often overlooked, they must be anticipated and incorporated into your project budgets.

These costs can sometimes be lumped in with overhead costs; however if the cost directly applies to a specific work activity, it’s a good practice to separate and track that cost as a separate cost type. This way, you can know the true cost of that activity. Managing these costs well ensures projects comply with legal and regulatory requirements and are protected against potential risks and delays.

How to Use Cost Types In Your Job Costing Process

While it might seem like a lot of work to keep track of and organize costs this way, the effort is worth its weight in gold. The granular level of detail in the cost components of each activity provides GCs with a lot of beneficial information. And by incorporating these cost types into a detailed job costing process, you can build a comprehensive financial image of an entire project.

Job costing provides several benefits, including:

Enhanced Financial Control - By understanding how different cost types behave and impact the total project cost, you can gain tighter control over expenditures, making adjustments as needed to stay within budget. Controlling a project budget through detailed cost type tracking also allows you to focus on areas of cost overrun and take action before it's too late. For project managers, having a detailed breakdown of costs by type empowers better financial forecasting and resource allocation across the entirety of that specific project.

Improved Pricing Strategy - Detailed knowledge of how costs are distributed in past projects can help you set more accurate bids for future projects. Think back to our earlier example: If you understand all the cost type components, it becomes easier to hold other costs constant while manipulating one specific cost type, like labor.

In this way, cost types can almost be thought of as ingredients in a recipe. Depending on what yield you want to make, whether you want the food to turn out a little sweeter or a little bit more savory, understanding the components gives you the control you need to manage construction costs and tailor the construction ‘recipe’ to just how you want it.

Strategic Decision Making - With clear insight into which aspects of a project’s scope consume the most resources, you can make informed decisions about where to invest in efficiency improvements, whether through technology, materials, or workforce training.

For example, imagine you’re starting a new project with a new labor workforce. You quickly realize that while your labor costs are high, productivity is lower than expected. This means it might be a good idea to train your workforce on how to perform more efficiently. Or, if your equipment costs are creeping higher and higher, it could be a sign that the aging equipment you own needs to be replaced or sold and rental equipment used instead.

💥 Read the full guide to mastering job costing for your construction business.

Tying it All Together

For emerging general contractors, mastering the art of cost tracking through detailed understanding and effective categorization of cost types isn’t just about keeping the books. It's about building a foundational competence that enhances your competitive edge, financial stability, and capacity to deliver successful projects.

And as with most things in our industry, successfully tracking costs starts with culture. Making sure every individual in your construction company (from the laborer in the field to the PM) understands the importance of accurately capturing costs will help ensure that bad information and poor recording habits are minimized. By creating a culture where the entire project management team systematically documents specific construction costs by type, you’ll have set the foundation to gather good data that drives good decisions.

👉 If you want to see how CrewCost makes tracking cost types easy, schedule a demo with our team.